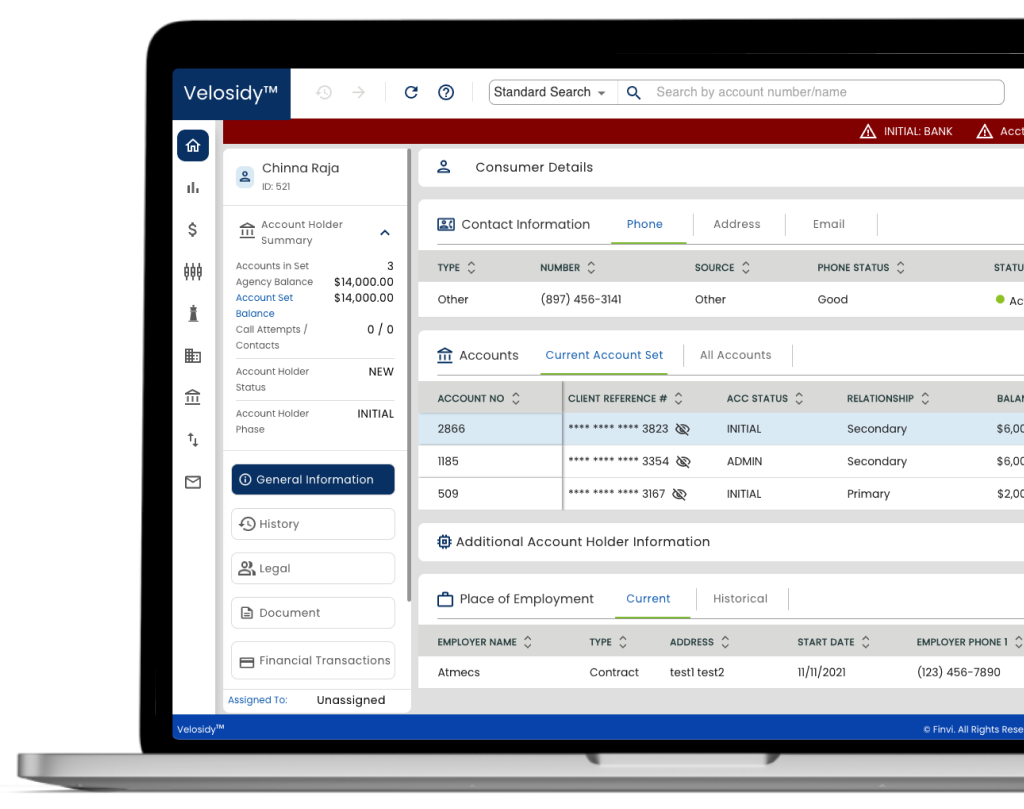

One integrated collections & payment solution provides all the features you need to drive your business.

Actionable insights for unbelievable business outcomes

A modern platform purpose-built for the ARM industry

Scalable configurations allow for the flexibility to implement your secret sauce

Open APIs allow you to easily connect to innovative technologies that drive business results

Always up-to-date software offers you immediate access to new features and functionality while eliminating the time and labor to upgrade

Machine learning, RPA, & AI automate workflows, campaigns, and consumer outreach

Analytics & reporting offer real-time insights so you can measure agency performance and identify opportunities

A modern, intuitive UX design increases agent speed & onboarding and drives a positive user experience

Enrich outreach strategies with AI-driven segmentation

Best Channel to Collect

Harness AI to identify the most effective communication method for each unique account. This approach accelerates collection processes, boosts response rates, and maximizes profitability while reducing costs.

Propensity to Pay (P2P) segmentation

Analyze comprehensive debtor data to identify the accounts most likely to make payments, allowing agents to focus on tasks that yield revenue.

Best Time to Call analytics

Implement data-driven pattern analysis to pinpoint the optimal times to contact consumers, ensuring higher engagement and efficiency.

Experience the Future of Collections

Modernize, simplify and scale while decreasing your cost to collect

Intelligent Outreach & Segmentation

AI- and ML-led predictive account prioritization, best-channel recommendations, and segmentation works behind the scenes to maximize outreach success and collections yield.

Innovation Without Limits

Evolve with your business instead of letting on-premise systems hold it back. This modern platform provides a future-proof foundation to enable innovation without disruption.

Boost Agent Productivity & Revenue

Agents reach the right accounts, with the right message, at the right moment, significantly increasing consumer payments.

Reduction in Total Cost to Collect

Reduce your total cost of ownership by significantly lowering IT costs, including implementation & customization, maintenance & upgrades, and hardware & hosting.

Always Up-to-Date Compliance

Regulatory compliance guardrails are natively built into workflows, so you can collect without worry and without distraction.

Security-First Design Principles

Hosted in the Oracle Cloud Infrastructure (OCI), your data has always-on security protection, with ISO, SOC 2 and PCI certifications.

.

A true platform for organic and strategic growth

Velosidy evolves without disruption as business demands shift, regulations tighten, and markets expand. Now you can outpace change rather than react to it — and tap into new lines of business.